This is not an financial advise, only for education purpose only.

Table of Contents

1) WHAT IS ANCHOR?

2) THE BORROWER

3) THE LOQUIDATOR

4) THE DEPOSITOR

5) HOW DOES ANCHOR ENSURERS A STABLE 19% APY?

6) RISKS

7) HOW DO I START?1. WHAT IS ANCHOR?

Anchor protocol is a decentralised money market, savings and lending platform on the Terra blockchain.

Think of it like a bank in traditional finance, where it connects borrowers with lenders and they both benefits. Lender earn interests from borrower and borrowers get the loan that they need.

In banks, fiat currency (e.g USD) are used to deposit and for borrowing. In Anchor, it is using UST (Terra stablecoin) as the main currency.

In crypto, since you don’t know who anybody is, Anchor does all these in a “trust-less” collateral lending manner where credit history and background checks are not needed.

Anyone can create a Terra Station Wallet (Terra’s native crypto wallet), provide a collateral and be able to take up a loan.

In that case, how does Anchor ensures that borrowers pay back their loan if there are no background checks?

Well, there are a few things in place that Anchor has to make sure borrowers repay their loans if not, at least Anchor will not lose out in value. Lets take a look.

2. THE BORROWER

Anchor requires borrowers to provide bAsset token (bonded assets) as collateral before making a loan. Just like how banks may use your house as collateral if you want to take up a loan.

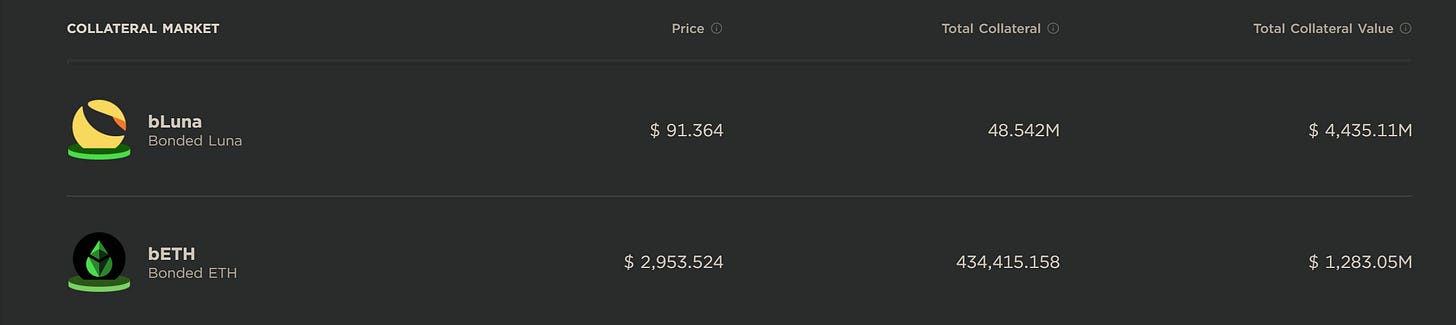

At the point of writing there are only 2 bAssets accepted by Anchor; bLUNA and bETH.

Borrowers will need to bond (stake) LUNA or webETH with Anchor under the bAsset tab to receive bLUNA and bETH respectively.

After providing the collateral, borrowers can loan up to 60% of the collateral value. This is also known as the maximum Loan-to-Value (LTV).

As with any other loans, there will be interest accrued against the loan. Currently the borrow interest rate is at 12.72% which this is determined by several factors such as, total value deposited, total value borrowed and type of collateral.

3. THE LIQUIDATOR

To prevent borrowers from defaulting on their loans, Anchor incentivizes liquidators to observe and liquidate loans with a borrow amount above the allowed borrowing limit of 60%.

Liquidation can happen when,

Price of collateral drops > collateral value drops > LTV goes above 60%

Accrued interest not paid off resulting in higher LTV

When a liquidation happens, it is bad for the borrower, the borrower gets to keep their borrowed UST but their collateral (bLUNA or bETH) gets liquidated, and they lose it forever.

In the liquidation process, Anchor Protocol will then auction the collateralised bLuna for UST instantly, at a discount to the market price to liquidators. The resulted UST is injected back into the Anchor to ensure that the lender's principle remains protected.

4. THE DEPOSITOR

The Depositor deposit (lends) Terra stablecoins (UST) to the Anchor money market to earn an APY of ~19%.

Depositors will then receive Anchor Terra (aTerra) in exchange for their deposit. aTerra token represents the Depositor’s share in the stablecoin pool and can later be redeemed to claim the initial stablecoin deposited, along with accrued interest earned.

5. HOW DOES ANCHOR ENSURERS A STABLE 19% APY?

Say Mary deposited 100k worth of UST into Anchor, hoping to earn 19% APY from it, Mary then receives aUST as a “receipt” to how much she has deposited.

John has 200k worth of LUNA and he wants to borrow 100k worth of UST (utilising 50% LTV).

John would bond the 200k LUNA and receive 100k UST.

John will also be required to pay 12% borrow interest.

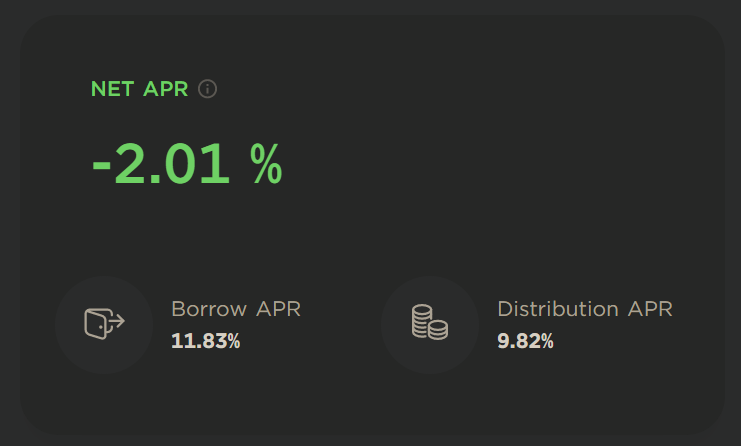

So toast, if John is only paying 12%, how is Mary going to receive 19%?

Remember the collateral that was collected?

Anchor has strategically accept only yielding assets to be collaterised. This is so that Anchor can use these collateral to earn staking APY from the respective channels.

Staking reward for LUNA is ~7% and webETH is ~3-4%

12% Borrow interest + 7% collateral’s staking APY = 19% deposit APY

Note, the borrow interest and collateral’s staking APY are subject to changes from time to time.

In event that the interest earned by Anchor is more than interest payable, the extra UST will be kept in Anchor’s Yield Reserve. This is to save up for “rainy days” when interest earned is lesser than interest payable, the shortfall will be taken from Yield Reserve.

6. RISKS

No risk, is the biggest risk.

-Anon

Bank Run

According to Investopedia,

“A bank run occurs when a large number of customers of a bank or other financial institution withdraw their deposits simultaneously over concerns of the bank's solvency. As more people withdraw their funds, the probability of default increases, prompting more people to withdraw their deposits. In extreme cases, the bank's reserves may not be sufficient to cover the withdrawals.”

If Anchor lends out too much of UST that Anchor to John(s), then Mary(s) may not be able to withdraw their UST, unless until John(s) pays back their loan.

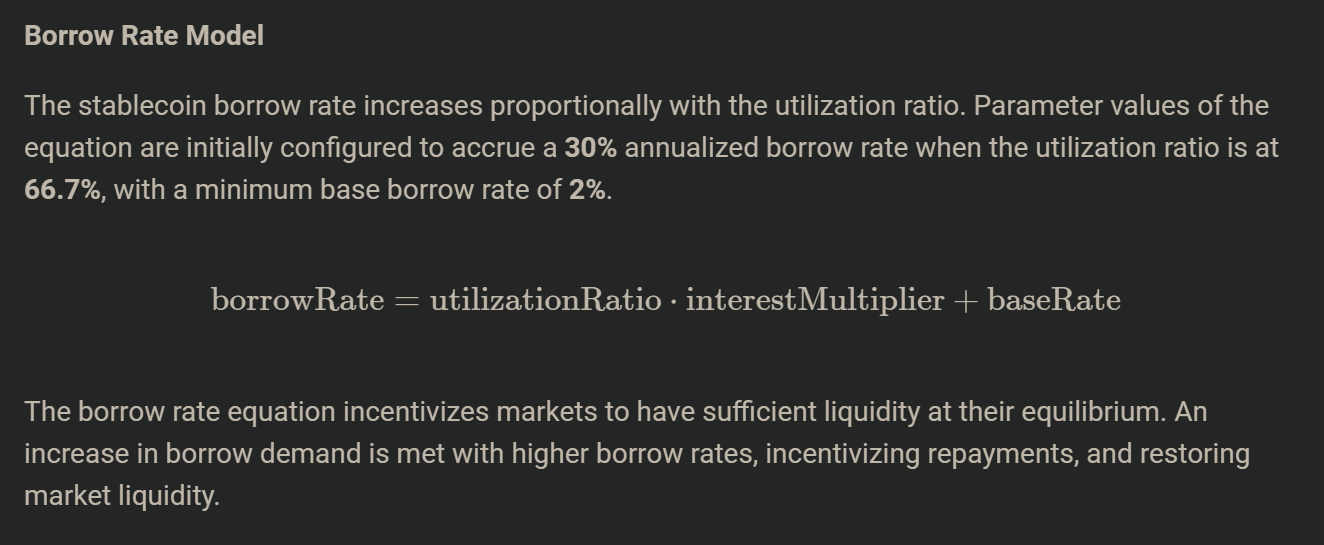

We can simply calculate this by, finding the Total Borrowed / Total Deposited. This is also referred to the Utilisation Ratio.

However, when the Utilisation Ratio increase, Anchor is programmed to increase the Borrow rate, which incentivise loan repayments and restoring market liquidity.

Smart Contract Risk

Just like any other DeFi protocols, Anchor runs on a smart contract.

As its name implies, a smart contract is a programmable and self-executing agreement deployed on a blockchain.

In other words, smart contracts execute transactions and activities based on sets of predefined rules and conditions.

Hence, a exceptionally skilful hacker may tamper the codes and withdraw all the money.

Liquidation Risk

As mentioned above, if the collateral (bLUNA/bETH) value drops and the LTV of John goes above 60%, part of the collateral will be liquidated and John will not be able to get back the collateral.

Stablecoin Depegging

UST is pegged to US$1 using a mechanism that is algorithmically based. An important thing to note is that stablecoin is 100% algorithmic and not backed by any collateral.

Pedro has done a great explanation on UST peg here. Highly suggest to watch the video to have a better understanding.

7. HOW DO I START?

I have made a step-by-step tutorial on how you can buy UST and start depositing into Anchor. Check them out here.